Q1 Hamptons Market Update

If 2024 follows 2023 booking patterns, the peak summer months in the Hamptons (May through August) are approximately 20%-30% of the way through the booking cycle for 2024. This indicates that a significant portion of bookings and revenue potential remains untapped. The data shows that early bookings tend to be more lucrative, highlighting the importance of strategies to encourage them (i.e. early bird discounts). Additionally, there’s a continued trend towards an increase in bookings closer to the check-in date, stressing the need for dynamic strategies to capitalize on this later booking surge to maximize occupancy and revenue.

Here is how each peak season month in 2024 is currently fairing:

May

- Compared to this time last year, the total number of bookings for May are up 14% but the average booking amount is down 14%, and the average nightly rate is down 4%.

- Mirroring the progression in 2023, total gross booking value so far represents 23% of the total at the end of May (sell-through rate).

- Despite a sell-through rate of only 23%, the average revenue per property had already constituted 69% of the final average revenue per property. This indicates that early bookings tend to be more lucrative on average than later ones.

June

- Compared to this time last year, the total number of bookings for June are up 11% but the average booking amount is down 12%, and the average nightly rate is down 9%.

- Mirroring the progression in 2023, total gross booking value so far represents 28% of the total at the end of June.

- Despite a sell-through rate of only 28%, the average revenue per property had already constituted 79% of the final average revenue per property. This indicates that early bookings tend to be more lucrative on average than later ones.

July

- Compared to this time last year, the total number of bookings for July are up 10% but the average booking amount is down 17%, and the average nightly rate is down 4%.

- Mirroring the progression in 2023, total gross booking value so far represents 30% of the total at the end of July.

- Despite a sell-through rate of only 30%, the average revenue per property had already constituted 79% of the final average revenue per property. This indicates that early bookings tend to be more lucrative on average than later ones.

August

- Compared to this time last year, the total number of bookings for August are up 18% but the average booking amount is down 4%, and the average nightly rate is down 2%.

- Mirroring the progression in 2023, total gross booking value so far represents 20% of the total at the end of August.

- Despite a sell-through rate of only 20%, the average revenue per property had already constituted 70% of the final average revenue per property. This indicates that early bookings tend to be more lucrative on average than later ones.

Takeaways:

- Early Booking Revenue: Properties booked early tend to bring in higher revenue on average. This could be due to a variety of factors such as early birds booking longer stays, more premium properties getting booked early, or higher prices due to early demand.

- Booking Volume Increases Over Time: A significant increase in the number of bookings as time progresses suggests a trend towards later bookings. Strategies to capitalize on this include dynamic pricing, targeted marketing campaigns as the date approaches, and incentives for early bookings to maintain high average revenue per property.

- Strategic Implications: For future planning, it is beneficial to focus on strategies that encourage early bookings to lock in higher revenue per property while also developing strategies to increase the volume of bookings over time, such as reducing minimum night stay restrictions.

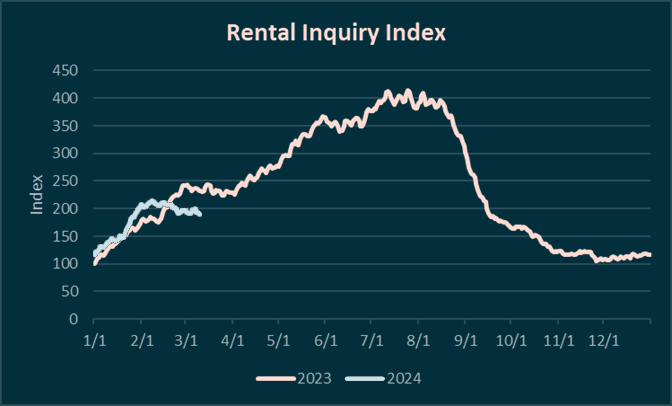

Rental Inquiry Index:

The chart below compares daily rental demand over the course of a year, with separate lines for 2023 and 2024. The index value, which is a proxy for rental demand, is plotted on the y-axis, while the x-axis represents time, specifically days of the year from January 1st to December 31st.

When comparing 2023 to 2024, rental demand began similarly in January. In late January / early February, demand in 2024 surpassed demand in 2023 for a 2-week period before falling behind. Rental demand starts to climb significantly in April, underscoring the importance of establishing correct pricing now to optimize performance for the summer season.